Denver, Colorado - January 27, 2026 - Bascom Northwest Ventures, LLC (“Bascom Northwest”) is pleased to announce the sale of Tempo at Riverpark Apartments. The 235-unit property was sold by a Bascom affiliated venture for $105,000,000 to a venture led by Hines. Tempo at Riverpark is located less than a mile from the Pacific Ocean in Oxnard, California and just outside Los Angeles. Bascom Value Added Apartment Investors Fund IV (“Fund IV”), an affiliate of The Bascom Group, LLC (“Bascom”), and a private investment group led by Bascom Northwest purchased property for $75,250,000 in 2018. Brian Wirtz, Managing Director of Bascom Northwest, assisted throughout the investment execution process.

Oxnard is less than an hour’s drive from Downtown Los Angeles and only minutes’ drive to the Pacific Ocean. Located between Thousand Oaks and Ventura, Oxnard has established itself as a premier upscale coastal beach town in Ventura County. With its pristine beaches, unbeatable weather, charming Channel Islands Harbor, and captivating Victorian-era architecture, Oxnard offers a diverse range of breathtaking sights that span from the ocean to the mountains.

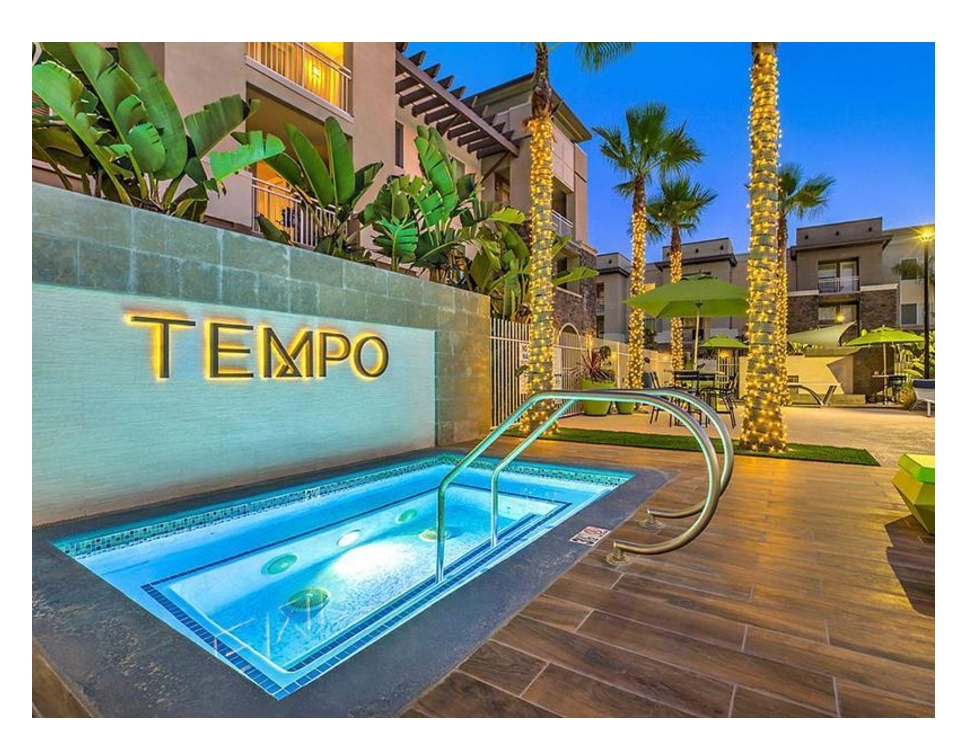

Tempo at Riverpark is a 235-unit apartment community located in Oxnard, California. This class “A” suburban multifamily community spans approximately 6.14 acres, offers spacious floor plans averaging 955 square feet, and is accompanied by luxurious interior finishes such as in-unit laundry, stainless steel appliances, custom sliding barn doors, large bedrooms with spacious open floor plans, balconies or patios, and much more. Amenities include an outdoor pool and spa, poolside cabanas, outdoor BBQ area, and fireplace, 24/7 fitness center, yoga/spinning room, and attached garages. The rental community is located adjacent to The Collection at RiverPark, with a California Coastal blend of retail stores, restaurants, cafes, grocery, and outdoor spaces anchored by Whole Foods Market, REI, 16-screen Cinemark movie theater, Bowlero and over 30 food and beverage options. Tempo at Riverpark was developed and constructed by the Wolff Company in 2015. It consists of 105 one-bedroom one bath units at 804 square feet, 118 two-bedroom two bath units at 1,036-1,065 square feet, and 12 three-bedroom two bath units at 1,270 square feet.

This combination of Oxnard’s intrinsics and property upgrades totaling $1 million set the stage for a successful investment execution by Bascom Northwest. Apartment Management Consultants (“AMC”) managed the community for Bascom over the holding period. Both parties were represented in the sale by Blake Rogers, Alex Caniglia, and Kip Malo at JLL.

Although Fund IV has closed for new investment and has been selling properties, Bascom Value Added Apartment Investors VI, LLC (“Fund VI” or the “Fund”), which is sponsored by Bascom, launched a new offering of its securities pursuant to Rule 506(c) under the Securities Act of 1933, as amended. Fund VI is focused on acquiring apartment communities throughout the U.S. that can be repositioned through value-add renovations, management improvements, recovery from being over leveraged and distressed, or may be a foreclosure and trading at a significant discount. The Fund has been actively raising capital and acquiring property assets. The Fund currently owns six apartment properties in five states totaling 1,138 units with approximately $83.8 million of equity invested. The Fund is seeking to raise an additional approximately $65.3 million in equity for this offering. For any questions regarding this Fund, please contact Chad Sanderson 949-955-0888 (ext. 123) or Joe Ferguson (ext. 120).

For additional information regarding this transaction or Bascom, please contact Brian Wirtz at (415) 205-5715 or Chad Sanderson (949) 955-0888 ext. 115.

About Bascom Northwest:

Bascom Northwest, a joint venture between Brian Wirtz and The Bascom Group, LLC ("Bascom"), was formed to acquire transitional multifamily assets in the northwestern United States. Since opening the office in San Francisco in late 2003, Bascom Northwest Ventures has acquired over 6,900 units at $897 million throughout the West Coast. The company executes market repositioning with capital improvements and institutional-quality property management resulting in increased income and significant added resale value.

About Bascom:

Bascom is a minority-owned private equity firm specializing in value-added multifamily, commercial, and non-performing loans and real estate related investments and operating companies. Bascom sources value-added and distressed properties including many through foreclosure, bankruptcy, or short sales and repositions them by adding capital improvements, improving revenue, and reducing expenses by realizing operational efficiencies through implementation of institutional-quality property management. Bascom, founded by principals Derek Chen, Jerry Fink, and David Kim, is one of the most active and seasoned buyers and operators of apartment communities in the U.S. Since 1996, Bascom has completed over $22.0 billion in multifamily value-added transactions encompassing 365 multifamily properties and over 105,000 units. Bascom's commercial transaction volume is $5.8 billion in total and amounts to over 23.4 million square feet. Bascom has ranked among the top 50 multifamily owners in the U.S. Bascom's subsidiaries and joint ventures include the Bascom Value Added Apartment Investors, Shubin Nadal Associates, Spirit Bascom Ventures, REDA Bascom Ventures, Bascom Northwest Ventures, Bascom Arizona Ventures, Harbor Associates, Village Partners Ventures, Consolidated Real Estate Strategies (CRES), BG Pearce, Meridian Investment Group, and Realm Group. Bascom's subsidiaries also include Premier Workspaces, one of the largest privately held executive suite, coworking and shared workspace companies in the U.S.

For additional information, please visit bascomgroup.com.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the terms of the offering and other statements identified by words such as "may," "will," "should," "anticipates," "believes," "expects," "plans," "future," "intends," "could," "estimate," "predict," "projects," "targeting," "potential" or "contingent," "guidance," "outlook" or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of Fund IV or Fund VI's management and are inherently subject to significant business, economic and competitive risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed, or implied by such forward-looking statements.

All information set forth herein speaks only as of the date hereof in the case of information about Bascom, Fund IV, Fund VI or the date of such information in the case of information from persons other than Bascom, and Bascom disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this communication.

Media Contact

Company Name: The Bascom Group, LLC

Contact Person: Jerome A. Fink - Managing Partner

Email: Send Email

Phone: 714-293-0888 (cell) | 949-955-2991 (office)

Address:7 Corporate Park, Suite 100

City: Irvine

State: CA 92606

Country: United States

Website: http://www.bascomgroup.com/