Latest News

With the right strategy, you can grow your savings nicely this year.

Via The Motley Fool · January 31, 2026

This actively managed fixed income ETF targets diversified bond exposure and reported a 5.09% annualized yield in its latest filing.

Via The Motley Fool · January 31, 2026

An overreliance on government contracts is turning out to be a headwind for BigBear.ai.

Via The Motley Fool · January 31, 2026

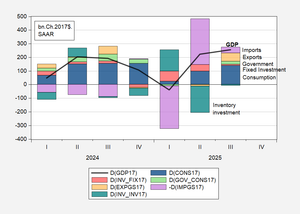

The slowing of the economy (as measured by domestic final sales) and the increase in the contemporaneous tariff rate have roughly equal coefficients.

Via Talk Markets · January 31, 2026

An illustrated guide to things that should make you uneasy.

Via Talk Markets · January 31, 2026

We discuss why the modern discussion of the division of labor is distorted by bad theory and political incentives.

Via Talk Markets · January 31, 2026

This bioscience company has had promising financials, yet one of its top executives exited her entire direct equity ownership in mid-January 2026.

Via The Motley Fool · January 31, 2026

The sell-off in Mastercard and Visa is a tremendous buying opportunity for long-term investors.

Via The Motley Fool · January 31, 2026

These two EV stocks are hot topics in the automotive industry, but only one is a buy for risk-tolerant investors.

Via The Motley Fool · January 31, 2026

A director at one of the top clinical-stage biotech companies sold 6,000 insider shares towards the end of January 2026 amid the company's stock having an underwhelming performance in 2025.

Via The Motley Fool · January 31, 2026

The Dimensional Global Core Plus Fixed Income ETF offers access to global bonds spanning government, corporate, and securitized markets.

Via The Motley Fool · January 31, 2026

Chip manufacturer NXP Semiconductors (NASDAQ: NXPI)

will be announcing earnings results this Monday after market hours. Here’s what to look for.

Via StockStory · January 31, 2026

Business development company Capital Southwest (NASDAQ:CSWC) will be announcing earnings results this Monday after market close. Here’s what investors should know.

Via StockStory · January 31, 2026

Meat company Tyson Foods (NYSE:TSN)

will be reporting results this Monday morning. Here’s what you need to know.

Via StockStory · January 31, 2026

Mortgage insurer MGIC Investment (NYSE:MTG) will be reporting earnings this Monday afternoon. Here’s what investors should know.

Via StockStory · January 31, 2026

Aerospace and defense company Woodward (NASDAQ:WWD) will be announcing earnings results this Monday afternoon. Here’s what to look for.

Via StockStory · January 31, 2026

Data analytics company Palantir Technologies (NASDAQ:PLTR) will be reporting results this Monday after market close. Here’s what you need to know.

Via StockStory · January 31, 2026

Global entertainment and media company Disney (NYSE:DIS)

will be announcing earnings results this Monday before market open. Here’s what investors should know.

Via StockStory · January 31, 2026

Life sciences company Revvity (NYSE:RVTY)

will be announcing earnings results this Monday before market open. Here’s what you need to know.

Via StockStory · January 31, 2026

Dialysis provider DaVita Inc. (NYSE:DVA)

will be reporting earnings this Monday after the bell. Here’s what you need to know.

Via StockStory · January 31, 2026

Democrats reject fast-track funding vote for government reopening, demand ICE and DHS reforms. Trump and Schumer near deal to avert shutdown.

Via Benzinga · January 31, 2026

Professional staffing firm Kforce (NYSE:KFRC) will be reporting earnings this Monday after the bell. Here’s what investors should know.

Via StockStory · January 31, 2026

Security systems manufacturer Napco (NASDAQ:NSSC) will be reporting results this Monday before the bell. Here’s what to look for.

Via StockStory · January 31, 2026

There has been much discussion, both here and around the world, of the possibility of a flight from the dollar. This has always been a serious risk since Donald Trump took office.

Via Talk Markets · January 31, 2026

Trump warned that a government shutdown could dent economic growth as Congress remains deadlocked over funding.

Via Benzinga · January 31, 2026

One of the top executives at a leading cloud software company exercised options in mid-January 2026, resulting in the sale of over 100,000 shares. This comes at a time when the company's stock had a strong performance throughout the month.

Via The Motley Fool · January 31, 2026

Rising adoption of generative AI models from OpenAI and Anthropic directly affects the major cloud computing platforms.

Via The Motley Fool · January 31, 2026

One of the top Ivy League schools in the country has a robust investment portfolio and recently made a major investment in this popular financial services app.

Via The Motley Fool · January 31, 2026

You need to look at ASML -- the company every tech stock relies on.

Via The Motley Fool · January 31, 2026

Obermeyer Loads Up On 187K TBIL Shares As the ETF May Soon Be Tokenizedfool.com

Obermeyer recently purchased $9 million worth of shares in an ETF that may soon be available to own on the blockchain.

Via The Motley Fool · January 31, 2026

These top-quality stocks are on sale right now.

Via The Motley Fool · January 31, 2026

The fitness innovator's challenges have resulted in a beaten-down stock price.

Via The Motley Fool · January 31, 2026

This ETF targets a diversified mix of investment grade bonds, aiming to deliver stable income and total return for investors.

Via The Motley Fool · January 31, 2026

This investment firm recently sold over $6 million in shares of one of Pacer's top large-cap ETFs. Is CMC slowing down the pace of its large-cap investments?

Via The Motley Fool · January 31, 2026

Salesforce and SentinelOne stocks saw insider buying heading into the new year.

Via The Motley Fool · January 31, 2026

Verizon issued strong Q4 results and strong guidance for 2026. We continue to recommend investment in the telecom giant for income.

Via Talk Markets · January 31, 2026

These market giants make great long-term investments.

Via The Motley Fool · January 31, 2026

One of these companies might reach a value of $10 trillion in just a few years.

Via The Motley Fool · January 31, 2026

Broadcom remains one of the best artificial intelligence (AI) stocks for long-term investors to buy now.

Via The Motley Fool · January 31, 2026

Some financial stocks would probably not mind rates staying the same or rising.

Via The Motley Fool · January 31, 2026

This investment firm recently increased its position on one of the top industrial REITs in the nation.

Via The Motley Fool · January 31, 2026

These innovative biotechs could have plenty of upside ahead.

Via The Motley Fool · January 31, 2026

For years, equity markets have leaned on the “Fed Put” – the belief that the central bank would reliably inject liquidity at the first sign of trouble. Warsh, however, is a vocal critic of the Fed’s tendency to “pamper” markets.

Via Talk Markets · January 31, 2026

Via Benzinga · January 31, 2026

It's hard to believe a stock could move this much in five years.

Via The Motley Fool · January 31, 2026

This leveraged ETF seeks to amplify daily returns of Alphabet Inc. through swap agreements, targeting investors with bullish GOOGL outlooks.

Via The Motley Fool · January 31, 2026

Accelerating investment in AI infrastructure will remain a strong tailwind for chip stocks -- and not just the GPU specialists.

Via The Motley Fool · January 31, 2026

CEO Mark Zuckerberg wants to bring personal superintelligence to the masses.

Via The Motley Fool · January 31, 2026

In spite of market gains, one thing has weighed on investors' minds in recent months.

Via The Motley Fool · January 31, 2026

Mars Sample Return would have turbo-charged Rocket Lab's revenue and added a feather to its cap.

Via The Motley Fool · January 31, 2026