Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

In this video lesson, I review all the data that suggests this market is on some very thin foundation. When price confirms (if it confirms), the sell-off has the potential to be very ugly.

Via Talk Markets · January 30, 2026

Precious metals saw

Via Talk Markets · January 30, 2026

Have the silver fundamentals changed? Likely not. But they were likely overpriced. If so, how much were they overpriced?

Via Talk Markets · January 30, 2026

After hitting record highs, gold and silver faced massive, record-breaking declines, illustrating the dangers of over-allocation and the psychological pitfalls of

Via Talk Markets · January 30, 2026

Theory has to guide your trading. Yesterday's options flow gave us the framework to avoid today's massacre. When your edge disappears, you step aside.

Via Talk Markets · January 30, 2026

Silver is getting crushed. At one point silver prices were down 37%.

Via Talk Markets · January 30, 2026

For many decades, the U.S. ran twin deficits, one at the Federal government level and the other on international trade.

Via Talk Markets · January 30, 2026

Stocks retreated on Friday as Big Tech remained under pressure, with the Dow and Nasdaq shedding triple digits and marking a third-straight weekly loss.

Via Talk Markets · January 30, 2026

Cricut designs and sells consumer cutting machines, accessories, and digital content that enable craft, design, and small-scale production projects.

Via Talk Markets · January 30, 2026

The dip in MSFT stock appears to be overdone. This is why value investors can look into various strategy plays.

Via Talk Markets · January 30, 2026

GameStop shares moved higher after CEO Ryan Cohen outlined plans for a major acquisition, with investor Michael Burry adding to his stake and backing the strategy.

Via Talk Markets · January 30, 2026

Monero is under renewed pressure as bearish sentiment tightens its grip across the broader crypto market.

Via Talk Markets · January 30, 2026

Cotton was a little higher after moving sharply lower the day before. Trends started to turn down on the daily reports.

Via Talk Markets · January 30, 2026

Despite renewed geopolitical uncertainty, things appear to be brightening up across the eurozone economy.

Via Talk Markets · January 30, 2026

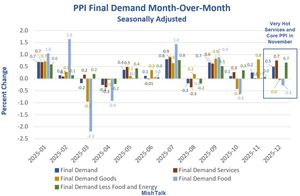

PPI rose 0.5% MoM (vs +0.2% MoM exp), lifting headline PPI to +3.0% YoY.

Via Talk Markets · January 30, 2026

Zcash has experienced a sharp decline over the past 24 hours, dropping more than 9% to a low of $329 amid a broader cryptocurrency market downturn.

Via Talk Markets · January 30, 2026

The gold and silver prices are in the midst of one of their largest (at least by dollar amount) moves downward, which the Wall Street media is attributing to the nomination of Trump’s new Fed chair candidate.

Via Talk Markets · January 30, 2026

Markets may look strong on the surface, but underneath, deep fractures are forming.

Via Talk Markets · January 30, 2026

Silver plunged in a clear way, and this doesn’t look like a correction. It looks like the beginning of the slide.

Via Talk Markets · January 30, 2026

People tend to overrate the importance of Fed chairs, as the Fed has a great deal of institutional inertia.

Via Talk Markets · January 30, 2026

25Q4Y/Y earnings are expected to be 10.9%. Excluding the energy sector, the Y/Y earnings estimate is 11.3%.

Via Talk Markets · January 30, 2026

The dollar entered this year on a bearish note, following a dramatic sell-off in most of January.

Via Talk Markets · January 30, 2026

EUR/USD wavers within the lower range of the 1.1900s after retrrateing from 1.2000.

Via Talk Markets · January 30, 2026

This isn't just a correction—it’s a massive liquidity washout driven by extreme leverage and

Via Talk Markets · January 30, 2026

Yesterday, Jerome Powell prematurely praised a decline in services inflation.

Via Talk Markets · January 30, 2026

Joby Aviation has been burning cash in the past few years as it worked on its aircraft, which it expects to enter service later this year or early next year.

Via Talk Markets · January 30, 2026

Bitcoin faces a continued downtrend, with analysts predicting struggles against the stock market and a delayed recovery until 2026.

Via Talk Markets · January 30, 2026

Meta Platforms' latest fourth-quarter earnings reignited investor enthusiasm for the social media stock as the results indicate the fiasco it created with unchecked spending on the metaverse is not being repeated with AI.

Via Talk Markets · January 30, 2026

Via Talk Markets · January 30, 2026

Indian share markets are trading lower with the Sensex trading 485 points lower, and the Nifty is trading 167 points lower.

Via Talk Markets · January 30, 2026

SoFi shares moved sharply higher after the company delivered a Q4 earnings beat, reporting adjusted EPS of $0.13 on record revenue of $1.01 billion and forecasting stronger profitability in 2026.

Via Talk Markets · January 30, 2026

Given that the Trump administration has made it clear it wants the Fed to ease monetary conditions, Warsh is an odd choice.

Via Talk Markets · January 30, 2026

Weibo Corp. creates, distributes, and discovers Chinese-language content.

Via Talk Markets · January 30, 2026

Gen Z will not like this message.

Via Talk Markets · January 30, 2026

The FTSE remains poised for its longest monthly winning streak in over 12 years and is also set to achieve weekly gains following losses in the prior week.

Via Talk Markets · January 30, 2026

Oil prices for Brent crude were on track for their biggest monthly increase since January 2022, while West Texas Intermediate was set for its largest monthly gain since July 2023.

Via Talk Markets · January 30, 2026

TSM remains a strategically critical semiconductor franchise with world-class manufacturing capabilities, strong structural demand drivers, and durable competitive advantages in process technology and scale.

Via Talk Markets · January 30, 2026

USD/JPY price analysis tilts to the upside as the dollar recovers on the Fed hold and the US Senate approval to avoid a shutdown.

Via Talk Markets · January 30, 2026

German headline inflation, according to the national measure, rebounded to 2.1% year-on-year in January, from 1.8% YoY in December.

Via Talk Markets · January 30, 2026

Bitcoin appears to be transitioning into a higher-degree Wave V, signaling the potential for continued downside pressure toward the mid-$70,000 region, with short-term volatility along the way.

Via Talk Markets · January 30, 2026

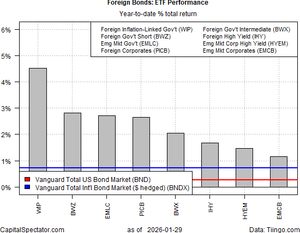

Diversifying into foreign bond markets has been a winning trade for US investors during the opening month of 2026.

Via Talk Markets · January 30, 2026

The USD/JPY pair is testing crucial support at the 200-day EMA near 152, with signs of stabilization suggesting a potential rebound from oversold conditions.

Via Talk Markets · January 30, 2026

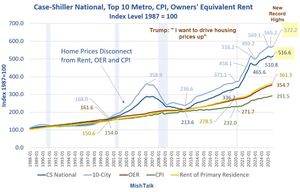

The market reacted dramatically to media reports that Kevin Warsh will be nominated today to succeed Federal Reserve Chair Powell at the held of the US central bank.

Via Talk Markets · January 30, 2026

On the heels of strong fourth-quarter earnings reports, Microsoft is opening down 8%, while Meta is trading up 10%.

Via Talk Markets · January 30, 2026

ExxonMobil's Q4 2025 results reveal a performance that surpassed expectations, reporting EPS of $1.71 and revenue of $82.31 billion.

Via Talk Markets · January 30, 2026

EUR/USD fell to 1.1919 on Friday. Despite this movement, the week ends with the US dollar experiencing its second consecutive decline.

Via Talk Markets · January 30, 2026

Gold pulls back after topping $5,500, pressured by a stronger Dollar and Fed policy uncertainty.

Via Talk Markets · January 30, 2026

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to challenge the company’s leadership in a shareholder vote.

Via Talk Markets · January 30, 2026

The breakdown of the Dollar Index below its long-term trend, in place since 2008, is not simply a technical accident.

Via Talk Markets · January 30, 2026

The gold outlook remains slightly deteriorated after a 4% plunge in a single session amid profit-taking.

Via Talk Markets · January 30, 2026

The metal market took a dramatic step back as Gold fell by over $400.

Via Talk Markets · January 30, 2026

Chevron reported adjusted Q4 EPS of $1.52, beating expectations, while revenue came in below estimates.

Via Talk Markets · January 30, 2026

China's manufacturing and non-manufacturing purchasing managers’ data will offer a first glimpse into how much momentum Asia’s largest economy carried into 2026.

Via Talk Markets · January 30, 2026

With 0.3% quarter-on-quarter growth, the German economy finally pulled out of stagnation at the end of last year.

Via Talk Markets · January 30, 2026

Walmart Stores, Inc. is the largest retailer in the world, operating a chain of over 10,000 discount department stores, wholesale clubs, supermarkets, and supercenters.

Via Talk Markets · January 30, 2026

Although the benchmark indices opened lower, they traded negatively throughout the session and ultimately closed red.

Via Talk Markets · January 30, 2026

Equity markets in Europe traded with no single trend on Thursday.

Via Talk Markets · January 30, 2026

Small businesses face cost pressures and uncertainty in 2026, but untapped pricing power and greater agility than large competitors offer paths to stronger growth.

Via Talk Markets · January 30, 2026

Markets took a hit as both stocks and US Treasuries declined amid growing speculation that President Trump is leaning toward nominating Kevin Warsh as the next Federal Reserve chair.

Via Talk Markets · January 30, 2026

Silver’s surge may look speculative, but it likely reflects deeper global uncertainty and eroding trust in financial and geopolitical systems rather than just dollar weakness.

Via Talk Markets · January 30, 2026

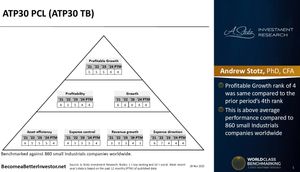

ATP30 Public Company Limited provides efficient personnel transport services for workers to industrial plants, primarily in Thailand’s Eastern Seaboard.

Via Talk Markets · January 30, 2026

The latest political and geopolitical headlines surrounding US President Donald Trump dominated markets early Friday, with all eyes on the announcement of his Federal Reserve Chair pick.

Via Talk Markets · January 30, 2026

Markets are consolidating after recent volatility, with the dollar’s modest rebound looking more like a pause than a trend change as risk currencies hold firm and the yen stays resilient.

Via Talk Markets · January 30, 2026

Mainstream expectations, those from Wall Street, economists, and corporate strategists, have congealed around a bullish economic outlook for 2026.

Via Talk Markets · January 30, 2026

The USD/CHF pair is attempting to form a bottom as speculation of Swiss National Bank intervention grows, making a rebound increasingly likely.

Via Talk Markets · January 30, 2026

Gold traders remain cautious over the next move after a dramatic sell-off in yesterday’s session.

Via Talk Markets · January 30, 2026

Trump is widely expected to nominate Kevin Warsh as the new Fed Chair today.

Via Talk Markets · January 30, 2026

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $64.00 during the early European trading hours on Friday.

Via Talk Markets · January 30, 2026

USDCHF continues to extend lower, reinforcing the prevailing bearish trend. The short-term Elliott Wave outlook suggests that the cycle from the November 25, 2025 high remains in progress as a five-wave impulse.

Via Talk Markets · January 30, 2026

Wells Fargo launched a proprietary in-house proxy voting system to manage client assets independently. This move follows a similar shift by JPMorgan and reflects growing pressure on third-party proxy advisors from anti-ESG regulatory scrutiny

Via Talk Markets · January 30, 2026

ExxonMobil’s Q4 results are expected to show earnings pressure as lower crude prices impact its upstream segment. While production remains strong, analysts warn that narrow refining margins may dampen the energy giant’s end-of-year performance.

Via Talk Markets · January 30, 2026

In this video, I break down the technical chart, highlight key support and resistance levels, and walk through how traders should respond.

Via Talk Markets · January 30, 2026

Tokyo inflation cooled more than expected, while retail sales and production declined. The Bank of Japan will wait to see if wage growth and prices increase before tightening again—most likely in June

Via Talk Markets · January 30, 2026