IonQ has been on fire lately. In the past six months alone, the company’s stock price has rocketed 72.6%, reaching $28.90 per share. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy IONQ? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does IONQ Stock Spark Debate?

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE:IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

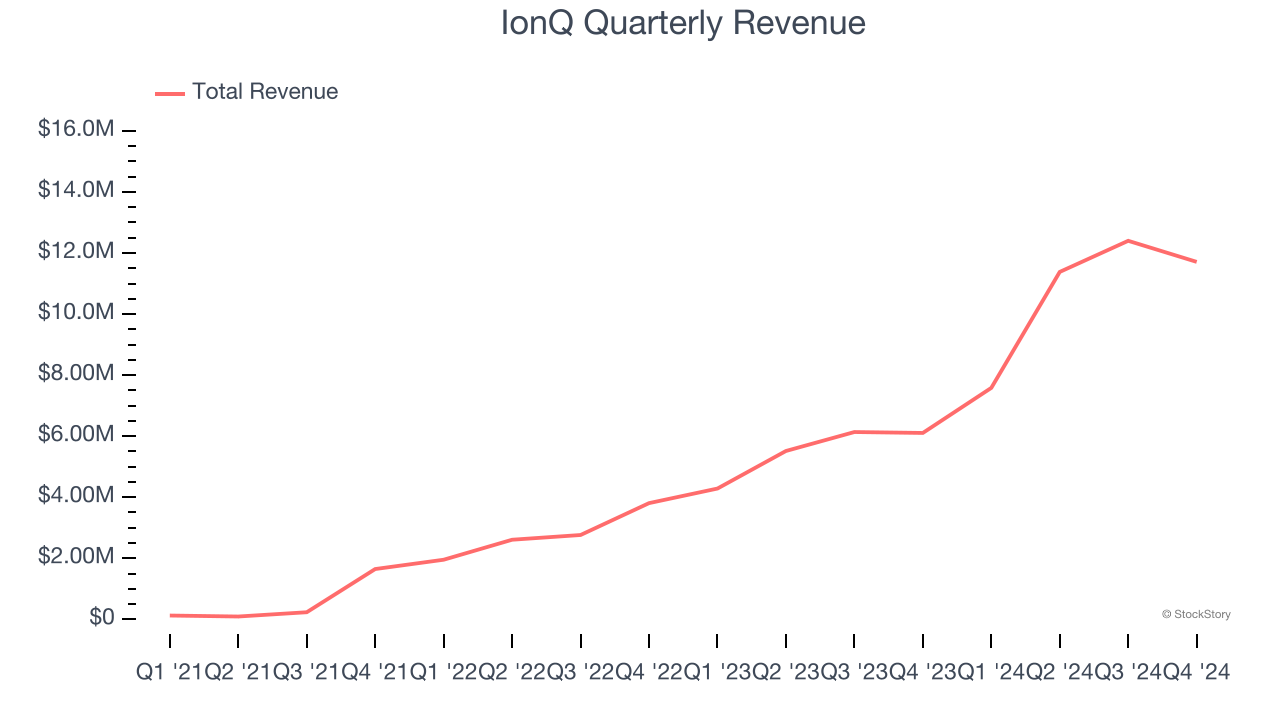

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, IonQ grew its sales at an incredible 174% compounded annual growth rate. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Adjusted Operating Margin Rising, Profits Up

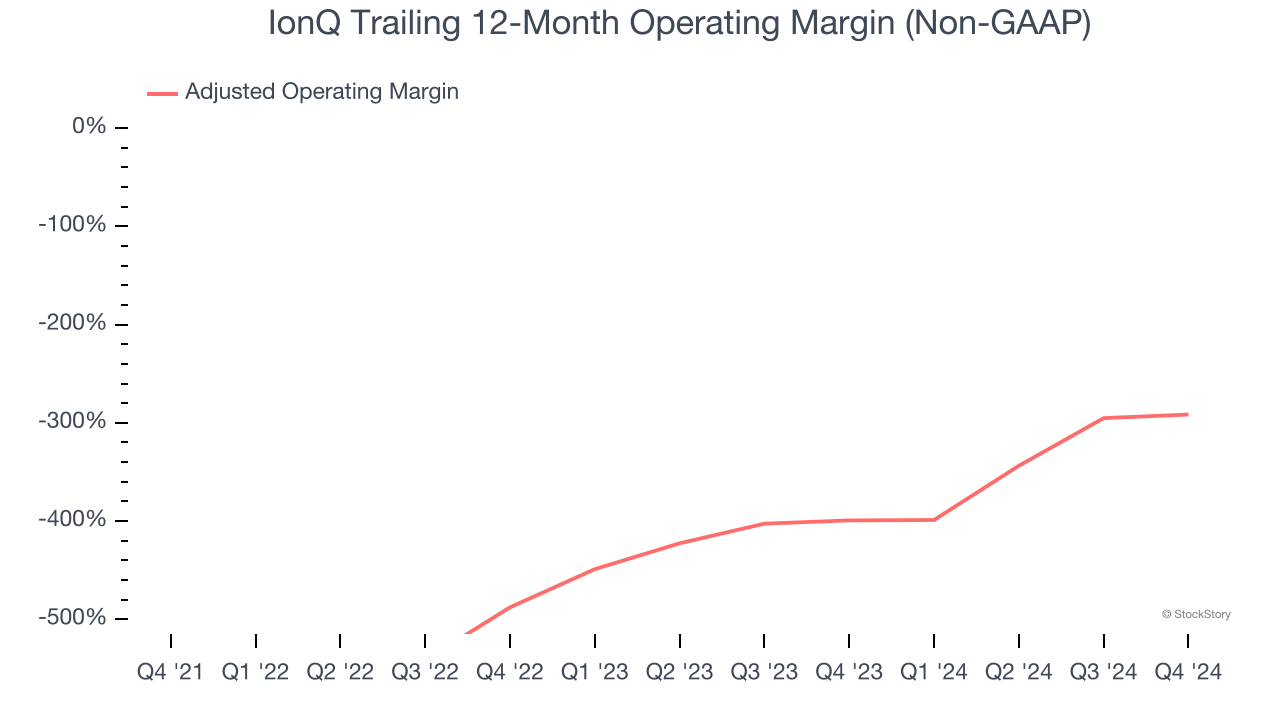

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

IonQ’s adjusted operating margin rose over the last four years, as its sales growth gave it operating leverage. Although its adjusted operating margin for the trailing 12 months was negative 292%, we’re confident it can one day reach sustainable profitability.

One Reason to be Careful:

Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

IonQ’s demanding reinvestments have drained its resources over the last four years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin was poor.

Final Judgment

IonQ’s merits more than compensate for its flaws, and after the recent rally, the stock trades at $28.90 per share (or 73.1× forward price-to-sales). Is now a good time to buy despite the apparent froth? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than IonQ

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.