Professional services firm Huron Consulting Group (NASDAQ:HURN) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 11.2% year on year to $404.1 million. The company expects the full year’s revenue to be around $1.62 billion, close to analysts’ estimates. Its non-GAAP profit of $1.68 per share was 45.3% above analysts’ consensus estimates.

Is now the time to buy Huron? Find out by accessing our full research report, it’s free.

Huron (HURN) Q1 CY2025 Highlights:

- Revenue: $404.1 million vs analyst estimates of $401 million (11.2% year-on-year growth, 0.8% beat)

- Adjusted EPS: $1.68 vs analyst estimates of $1.16 (45.3% beat)

- Adjusted EBITDA: $41.49 million vs analyst estimates of $41.47 million (10.3% margin, in line)

- The company reconfirmed its revenue guidance for the full year of $1.62 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $7.20 at the midpoint

- Operating Margin: 8.1%, up from 5.5% in the same quarter last year

- Free Cash Flow was -$108.7 million compared to -$139.5 million in the same quarter last year

- Market Capitalization: $2.25 billion

“Driven by strong growth across all three operating segments, revenues before reimbursable expenses (RBR) grew 11% over the first quarter of 2024, while we continued to expand our margins,” said Mark Hussey, CEO and president of Huron.

Company Overview

Founded in 2002 during a time of significant regulatory change in corporate America, Huron Consulting Group (NASDAQ:HURN) is a professional services company that helps organizations develop growth strategies, optimize operations, and implement digital transformation solutions.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.56 billion in revenue over the past 12 months, Huron is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

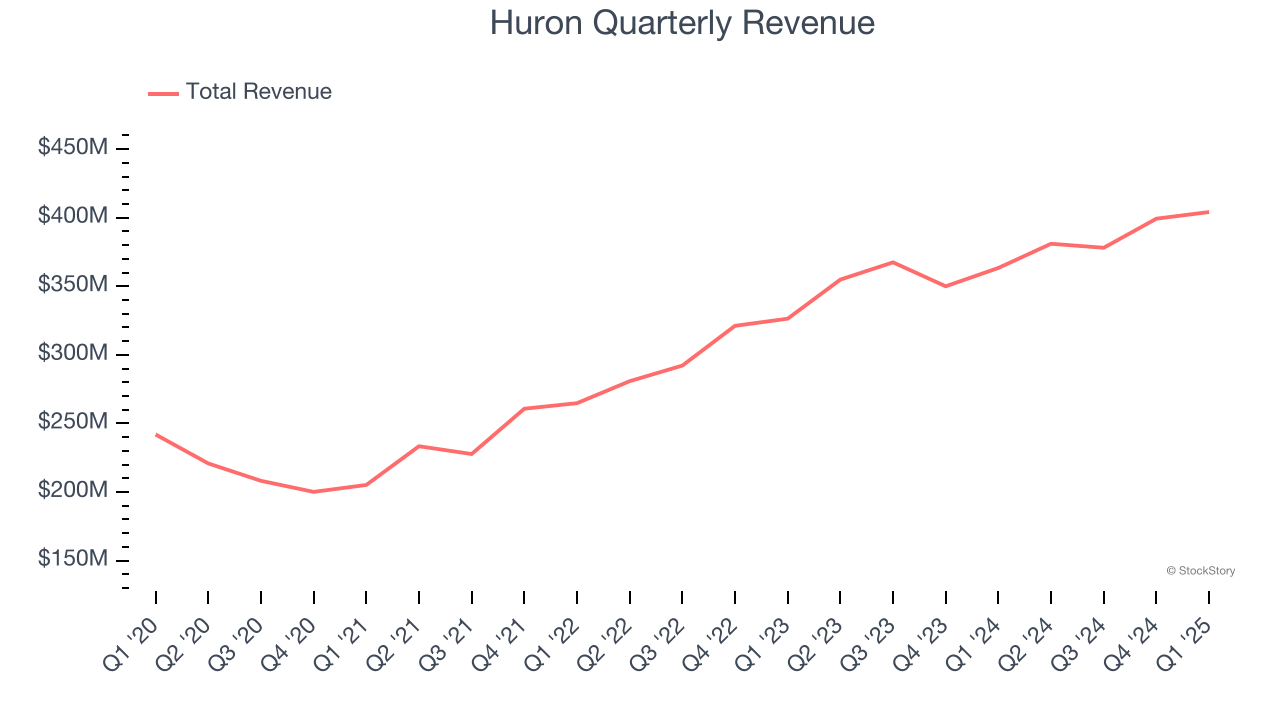

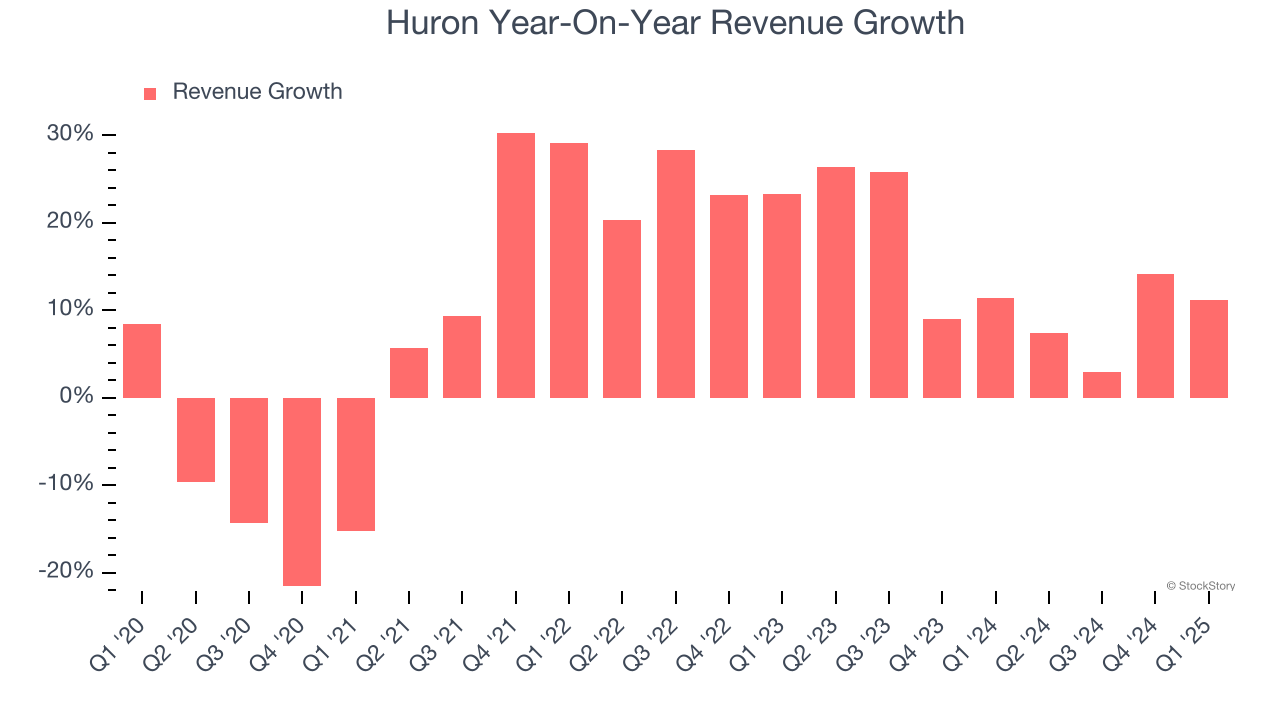

As you can see below, Huron grew its sales at an impressive 9.7% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Huron’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Huron’s annualized revenue growth of 13.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Huron reported year-on-year revenue growth of 11.2%, and its $404.1 million of revenue exceeded Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

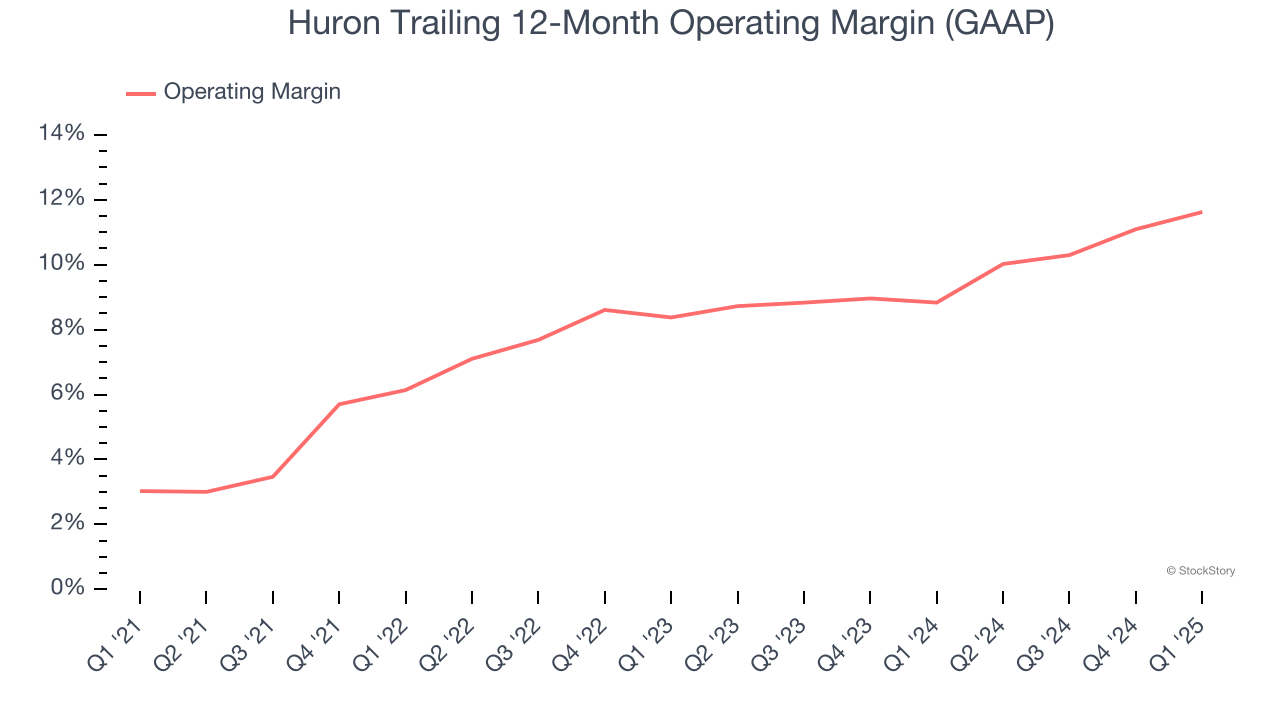

Huron was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.2% was weak for a business services business.

On the plus side, Huron’s operating margin rose by 8.6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Huron generated an operating profit margin of 8.1%, up 2.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

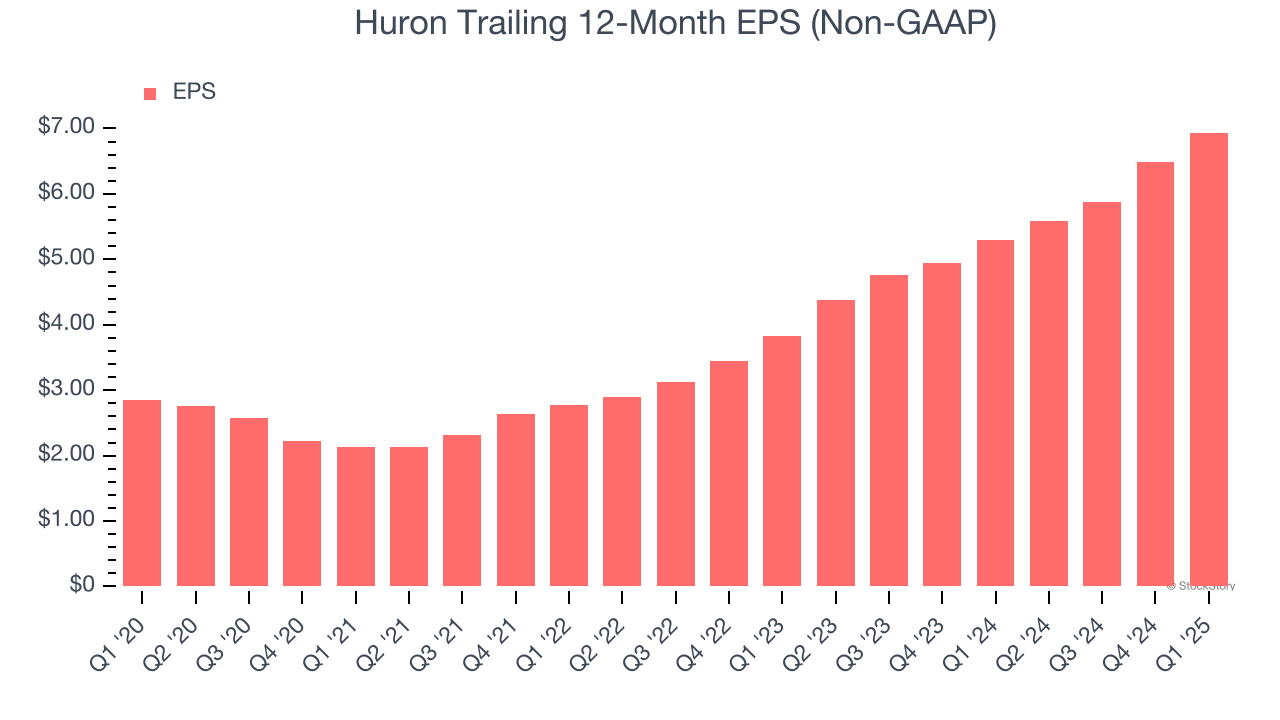

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

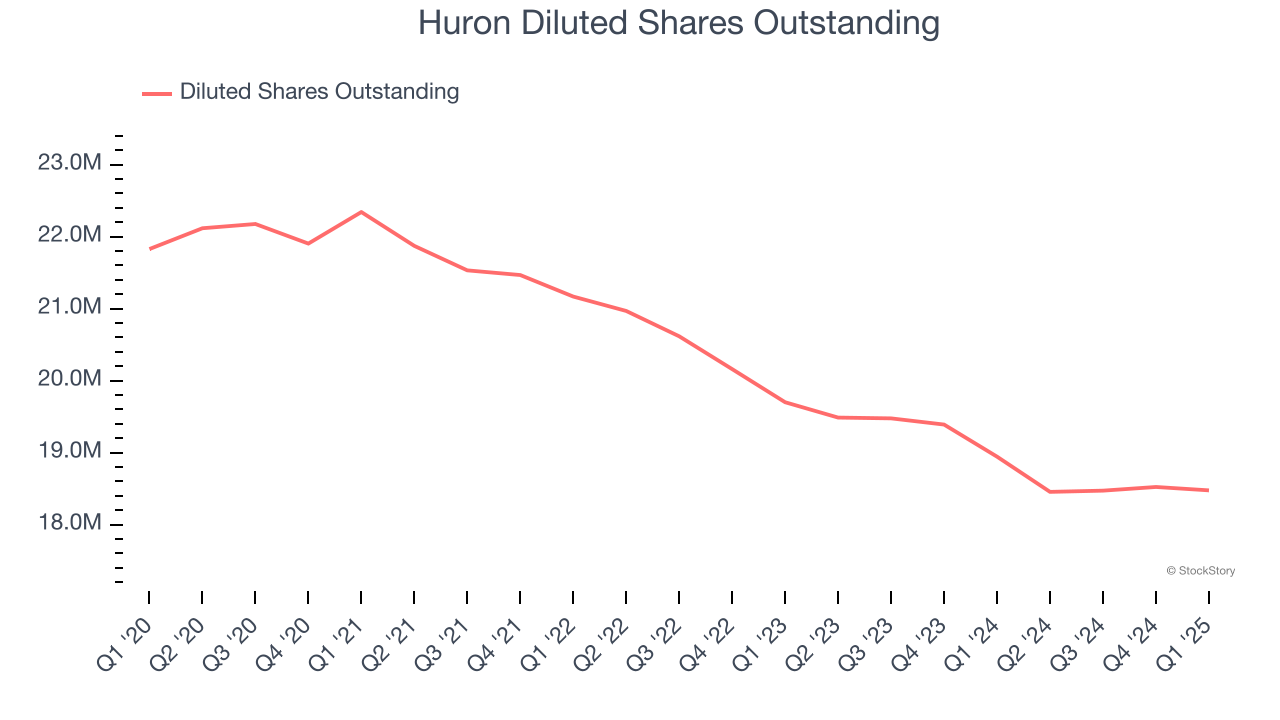

Huron’s EPS grew at an astounding 19.5% compounded annual growth rate over the last five years, higher than its 9.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Huron’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Huron’s operating margin expanded by 8.6 percentage points over the last five years. On top of that, its share count shrank by 15.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q1, Huron reported EPS at $1.68, up from $1.23 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Huron’s full-year EPS of $6.94 to grow 6.1%.

Key Takeaways from Huron’s Q1 Results

We were impressed by how significantly Huron blew past analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.9% to $138.60 immediately after reporting.

Huron had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.