Online marketplace Etsy (NASDAQ:ETSY) announced better-than-expected revenue in Q1 CY2025, but sales were flat year on year at $651.2 million. Its GAAP loss of $0.49 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Etsy? Find out by accessing our full research report, it’s free.

Etsy (ETSY) Q1 CY2025 Highlights:

- Revenue: $651.2 million vs analyst estimates of $642 million (flat year on year, 1.4% beat)

- EPS (GAAP): -$0.49 vs analyst estimates of $0.47 (significant miss)

- Adjusted EBITDA: $171.1 million vs analyst estimates of $164.2 million (26.3% margin, 4.2% beat)

- Q2 2025 guidance: year-on-year decline in GMS similar to or slightly better than Q1

- Operating Margin: -3.4%, down from 10.5% in the same quarter last year

- Free Cash Flow Margin: 7.1%, down from 35.7% in the previous quarter

- Active Buyers: 94.78 million, down 1.61 million year on year

- Market Capitalization: $4.94 billion

"Etsy's first quarter 2025 financial results were aligned with our expectations, with solid adjusted EBITDA performance despite pressure on the top line," said Josh Silverman, Etsy Inc. Chief Executive Officer.

Company Overview

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ:ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

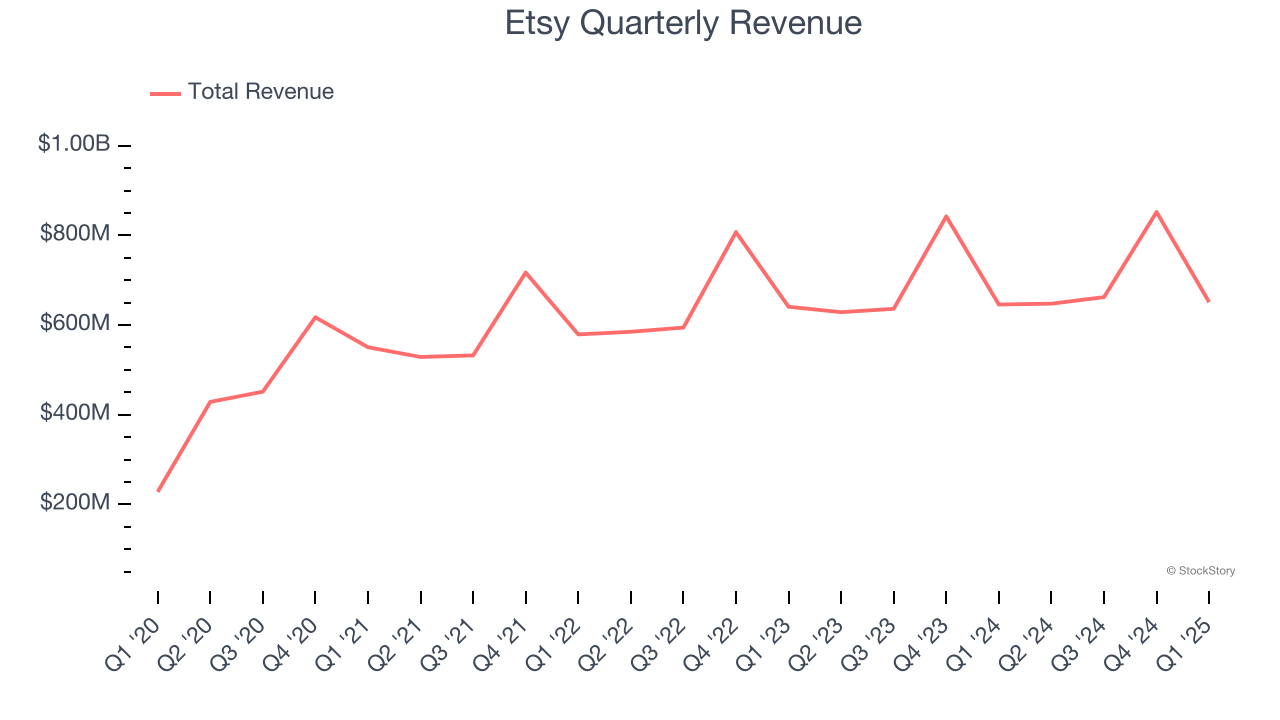

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Etsy’s sales grew at a tepid 6.1% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer internet sector and is a tough starting point for our analysis.

This quarter, Etsy’s $651.2 million of revenue was flat year on year but beat Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Active Buyers

Buyer Growth

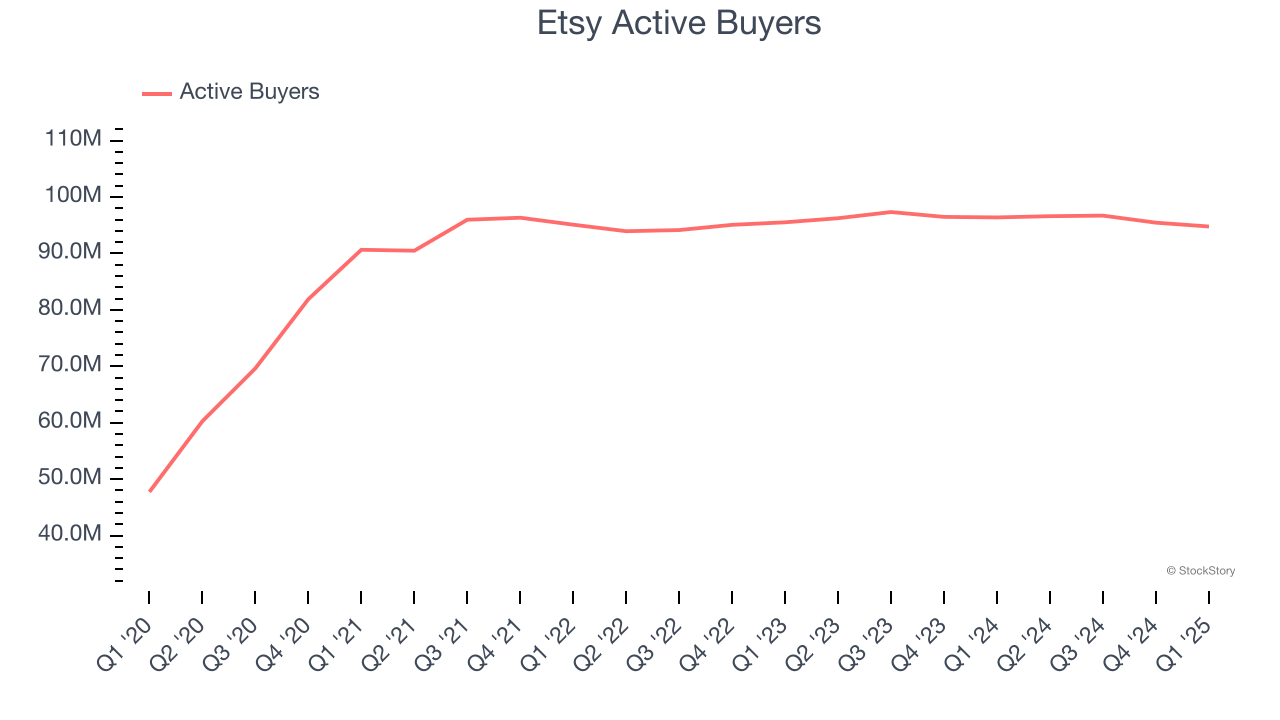

As an online marketplace, Etsy generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Etsy struggled with new customer acquisition over the last two years as its active buyers were flat at 94.78 million. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Etsy wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q1, Etsy’s active buyers decreased by 1.61 million, a 1.7% drop since last year. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for buyers yet.

Revenue Per Buyer

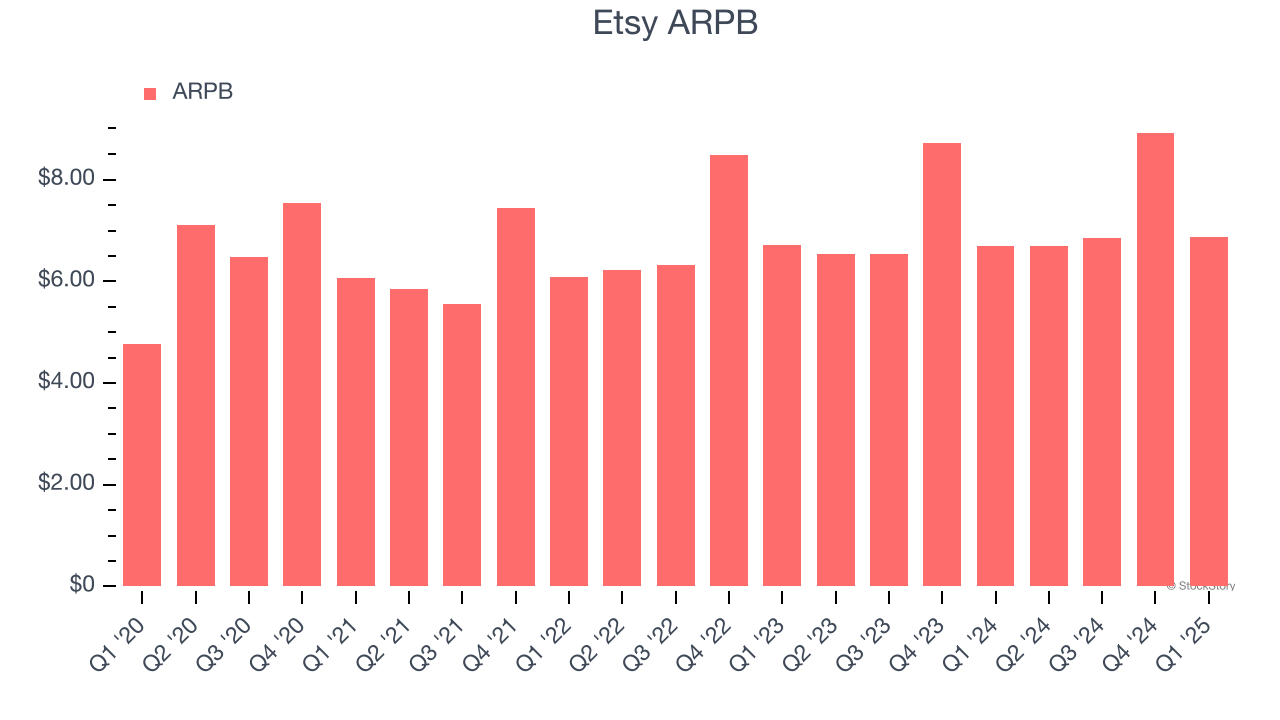

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much the company earns in transaction fees from each buyer. ARPB also gives us unique insights into a user’s average order size and Etsy’s take rate, or "cut", on each order.

Etsy’s ARPB growth has been subpar over the last two years, averaging 2.9%. This raises questions about its platform’s health when paired with its flat active buyers. If Etsy wants to grow its buyers, it must either develop new features or lower its monetization of existing ones.

This quarter, Etsy’s ARPB clocked in at $6.87. It grew by 2.5% year on year, faster than its active buyers.

Key Takeaways from Etsy’s Q1 Results

We enjoyed seeing Etsy beat analysts’ revenue and EBITDA expectations this quarter. Guidance seemed relatively in line with expectations, considered a positive amid the uncertain macro. Overall, this quarter had some key positives. The stock traded up 8.9% to $50.25 immediately after reporting.

Is Etsy an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.