Home improvement retailer Lowe’s (NYSE:LOW) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 1.6% year on year to $23.96 billion. The company’s full-year revenue guidance of $85 billion at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP profit of $4.33 per share was 2.1% above analysts’ consensus estimates.

Is now the time to buy Lowe's? Find out by accessing our full research report, it’s free.

Lowe's (LOW) Q2 CY2025 Highlights:

- Revenue: $23.96 billion vs analyst estimates of $23.99 billion (1.6% year-on-year growth, in line)

- Adjusted EPS: $4.33 vs analyst estimates of $4.24 (2.1% beat)

- The company lifted its revenue guidance for the full year to $85 billion at the midpoint from $84 billion, a 1.2% increase

- Adjusted EPS guidance for the full year is $12.33 at the midpoint, beating analyst estimates by 0.9%

- Operating Margin: 14.5%, in line with the same quarter last year

- Free Cash Flow Margin: 15.6%, up from 11.6% in the same quarter last year

- Same-Store Sales rose 1.1% year on year (-5.1% in the same quarter last year)

- Market Capitalization: $143.7 billion

"This quarter, the company delivered positive comp sales driven by solid performance in both Pro and DIY. Despite challenging weather early in the quarter, our teams drove both sales growth and improved profitability. I'd also like to thank our front-line associates for their outstanding service which led to another increase in customer satisfaction scores." said Marvin R. Ellison, Lowe's chairman, president and CEO.

Company Overview

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $83.61 billion in revenue over the past 12 months, Lowe's is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To accelerate sales, Lowe's likely needs to optimize its pricing or lean into international expansion.

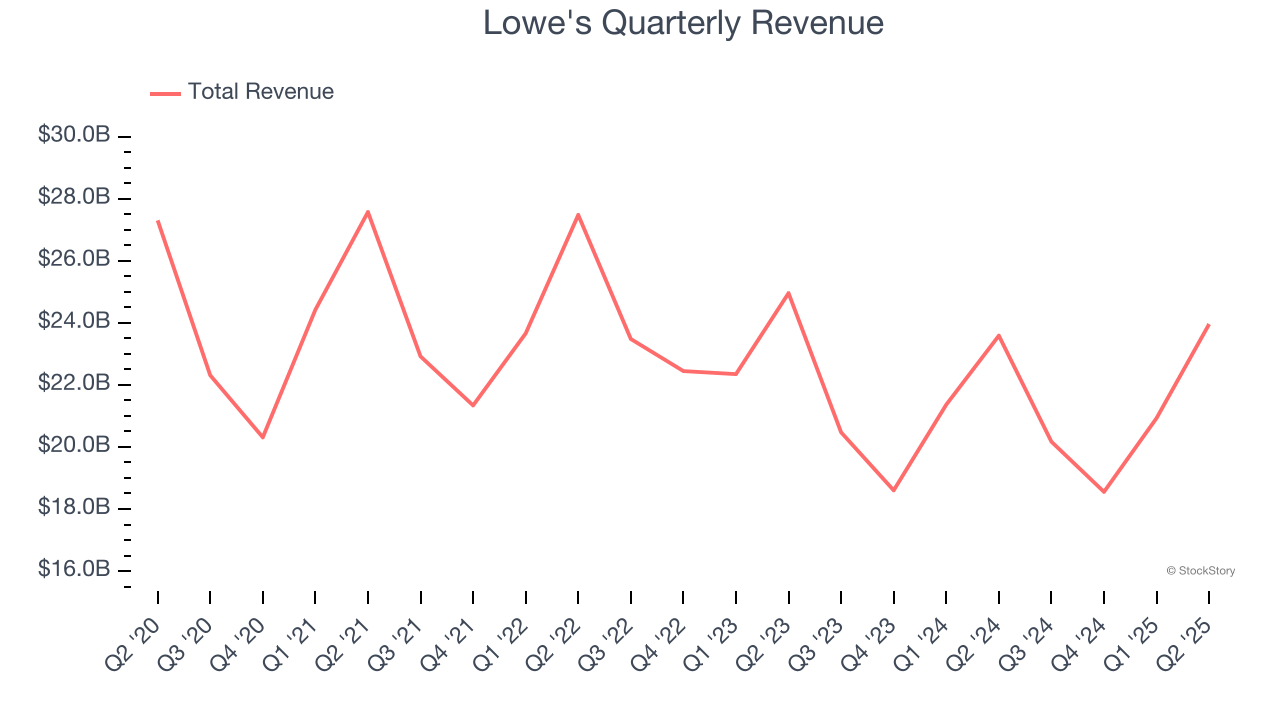

As you can see below, Lowe’s sales grew at a sluggish 2.6% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores.

This quarter, Lowe's grew its revenue by 1.6% year on year, and its $23.96 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, similar to its six-year rate. This projection is above the sector average and indicates its newer products will help maintain its historical top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from Lowe’s Q2 Results

It was good to see Lowe's narrowly top analysts’ gross margin expectations this quarter. We were also glad its full-year EPS guidance slightly exceeded Wall Street’s estimates. Looking ahead, full-year EPS guidance exceeded expectations, so zooming out, we think this was a decent quarter overall. The stock traded up 2.2% to $262.03 immediately following the results.

So do we think Lowe's is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.