German American Bancorp currently trades at $40.13 per share and has shown little upside over the past six months, posting a middling return of 2.2%.

Is now the time to buy GABC? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Does GABC Stock Spark Debate?

Founded in 1910 during a wave of community banking expansion in the Midwest, German American Bancorp (NASDAQ:GABC) is a financial holding company that provides banking, wealth management, and insurance services across southern Indiana and Kentucky.

Two Positive Attributes:

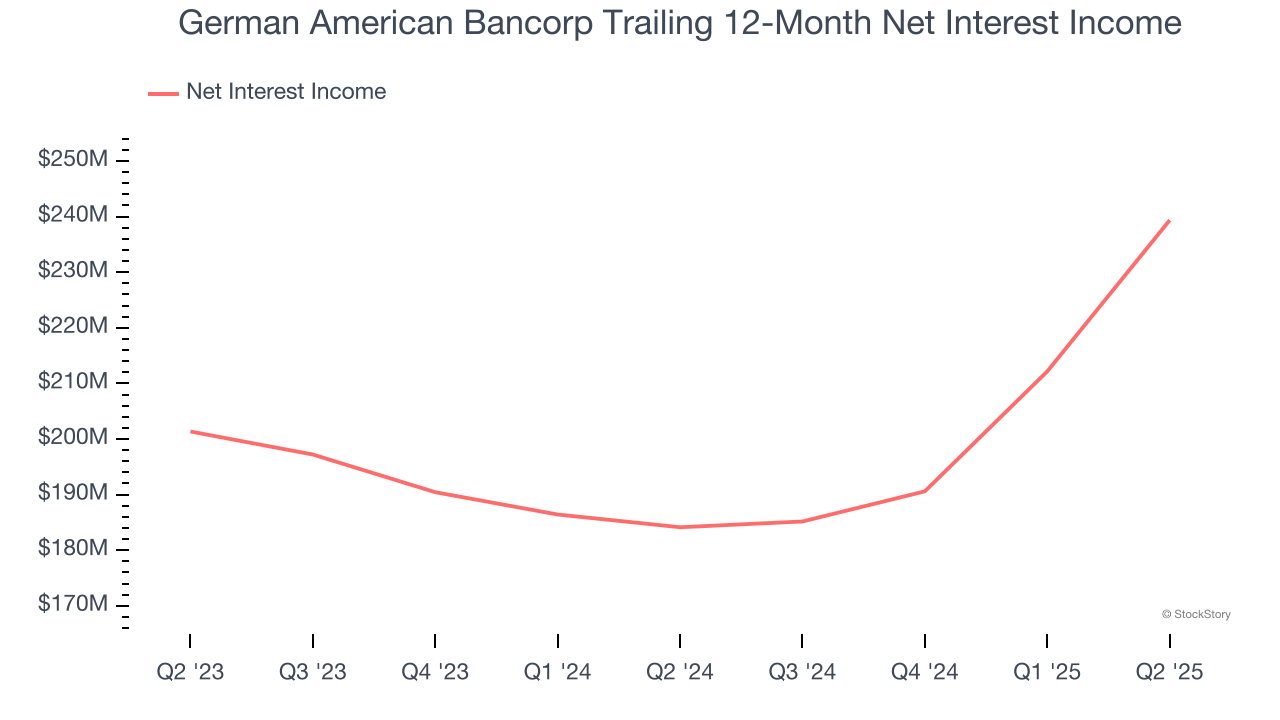

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

German American Bancorp’s net interest income has grown at a 13.3% annualized rate over the last five years, better than the broader banking industry and faster than its total revenue. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

2. Projected Net Interest Income Growth Is Remarkable

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect German American Bancorp’s net interest income to rise by 26.9%, an improvement versus its 9% annualized growth for the past two years.

One Reason to be Careful:

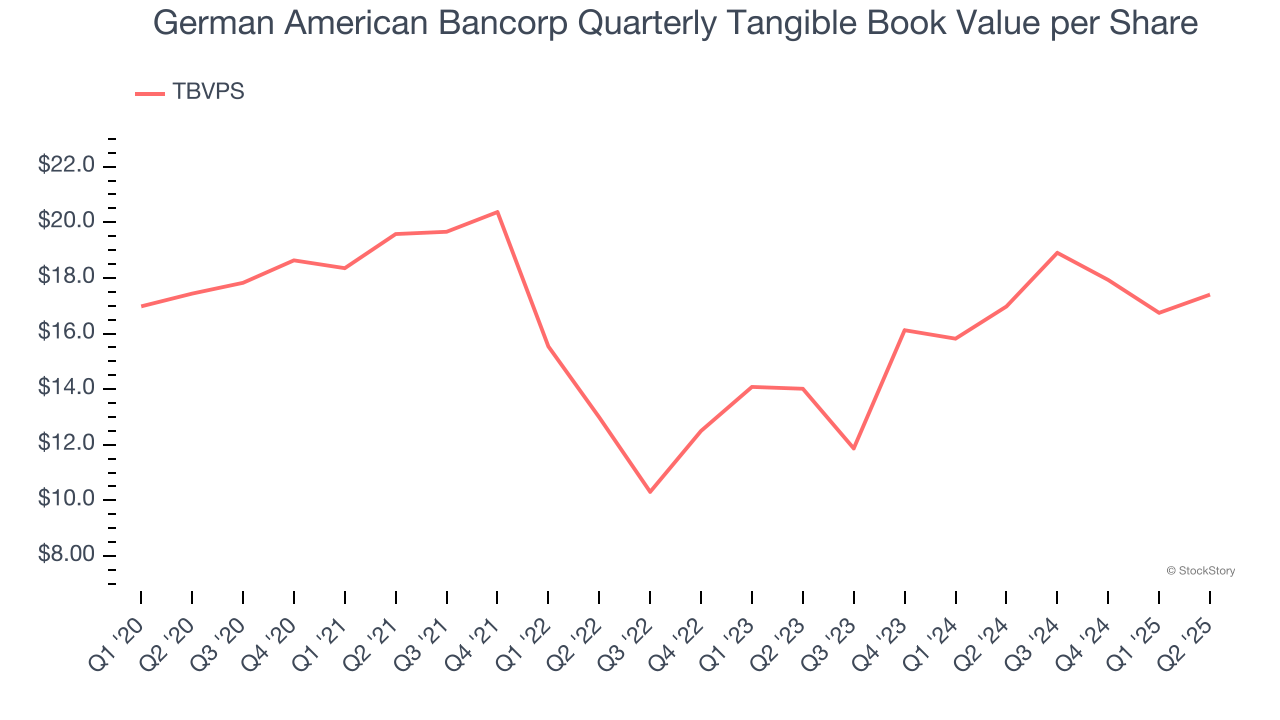

TBVPS Growth Demonstrates Strong Asset Foundation

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Although German American Bancorp’s TBVPS was flat over the last five years. the good news is that its growth has recently accelerated as TBVPS grew at a decent 11.4% annual clip over the past two years (from $14.01 to $17.40 per share).

Final Judgment

German American Bancorp’s positive characteristics outweigh the negatives, but at $40.13 per share (or 1.3× forward P/B), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.